“We’ve sent out several hundred of these letters in just the past couple of days," said Alex Traverso, communications chief for the state Bureau of Cannabis Control.

California Cannabis Businesses seem to be as confused about the regulations as those that are out to enforce them. With various licensing needed depending on the type of operation – it’s estimated that over 50% of current retailers are operating in a very grey area – or even worse – complete noncompliance which could result in hefty fines and much more.

Most of the warnings that are quite threatening are the first sign of what many suspects will be ongoing raids throughout the state on unlicensed operations such as dispensary or collective storefronts, delivery services, and those manufacturing and distributing Cannabis products without the proper licenses or not in compliance with regulations. Traverso goes on to state, “We’ve been visiting licensees and doing compliance checks focused on education, these letters represent the first step in the Bureau’s efforts against unlicensed.” His statements were taken at face value. If these businesses fail to comply with new regulations the state is poised to take action, something many people were worried about as voters promptly voted in a very complicated Recreational “Adult Use of Marijuana” Act – unknowing that medicinal patients would be affected in drastic ways.

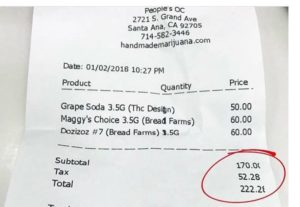

“It’s costing me nearly $700.00 per month to get the high strength CBD and THC oils my son takes,” Joanne Rasmussen of San Jose complained to me, “I don’t understand why parents and patients are having to cope with prices that are nearly double and with unreasonable taxes to boot!” And by far she’s not alone. “I just spent $186.00 on concentrates that used to cost less than half of that” stated a disgruntled Adam K. of Santa Cruz, “I remember the good old days when we called a friend for a bag of weed, then we got prop 215 and could get what we needed all over the place in dispensaries. Now it’s changing back to calling your friend again.” He went to tell me “Most of the people I know are doing business on the down-low, they don’t want to pay the taxes and don’t want to make corporations rich in order to get medicinal cannabis.”

And, this is exactly what the state warns of. But, what the state isn’t thinking about is the more they push on existing businesses that have some type of protocol in place for safe products – the more costly the products become and the more likely a patient or user is going to look to the Black Market for their Cannabis needs. As an advocate of decades, this is one of my own biggest worries. In that market rarely are there analytics or labs, rarely does the buyer know where the Cannabis came from that made the oil or concentrate, and even more rare is knowing that it’s free of pesticides when it was grown and processed. With regulation the Black Market always grows. The state estimated 60% would comply with Proposition 64 regulations in early January, only a month later the State Bureau of Cannabis Control has reversed the numbers to 40/60 as far as the percentage of compliance. With such a large number of small companies attempting to compete with commercial entities, without a doubt both consumers and purveyors are taking the risk to pay less.

The hefty taxes are also drawing complaints from some business owners and activists alike. The argument is the same – keeping a high rate of taxes will keep the state’s massive black market for marijuana alive and even healthier than it was before Proposition 64 which many hailed as ‘The End of Prohibition’. “That couldn’t be further from the truth”, Roger a well-known grower stated to me in a private conversation, “The voters were caught off guard, they thought they’d be helping kids in schools instead of making it hard for people to get Cannabis Medications.”

During a recent meeting in Sacramento, the state’s new Cannabis Advisory Committee agreed to discuss taxes at a future session. And Rich Miller, president of the American Alliance for Medical Cannabis, asked the state to consider reducing the tax rate for seniors and medical patients.

But Keith Humphreys, a psychiatry professor at Stanford University who studies marijuana policy, is urging the state not to cave to pressure to reduce taxes rates just a few weeks after the legal market opened. “I hope the state holds its nerve because of this problem. Even if it even is a problem, it will correct itself.” But many disagree. “The cost of Cannabis in a dispensary is the reason why my friends aren’t going anymore”, Donna S. of Stockton said with a tremor in her voice, “It scares me to buy from people who I don’t know. I don’t know how to read those labs anyway but feel better when I get them with oil that I buy. I can’t afford the tax and don’t know how to grow. What am I supposed to do?” And she’s not alone in that regard. While literally 10’s of thousands of Cannabis gardens have popped up around the state, many that are in need medicinally counted on the dispensaries and collectives to provide them with what they needed.

All cannabis legally sold in California now comes with a 15 percent excise tax. On its own, that rate is in line with, or below, the tax imposed in most other states that have legalized recreational cannabis. The huge problem? The same tax is being passed on to the medicinal patients that have enjoyed their voter initiated rights under Proposition 215 for over 20 years without this added cost. But that’s just the beginning of the tax scene. If patients don’t ‘register’ with their local municipality they’ll also pay even more as described below. “You’ve got to be kidding me, there’s no way I’ll register with my county and become a known Cannabis Patient with them in order to save on taxes I should never be charged” Declared Sheryl Fannon of Lamont, “I’d rather take my chances on what I can get from friends and other people I know.”

Most California cities that allow marijuana stores have tacked on local taxes, typically 5 to 10 percent. In a few cities, the local rate is as high as 15 percent. That’s in addition to the regular sales tax, which typically runs between 8 and 10 percent. And of course this is why so many voters that did not read quickly hit the YES on 64. As always there’s huge promises and this is what we saw as far as where this tax money would go:

The big question is how did voters approve a recreational law that had such a huge negative impact on Medical marijuana consumers who are now paying at least 20 percent tax on every purchase if not more, and recreational consumers are paying between a low of 28 percent and as much as 40 percent. Obviously Proposition 64 was not meant to protect consumers, it was meant to create revenue for the state and for the corporations that can afford the costly licensing and taxation.

For most of the states residents such as myself, it’s a watch and wait game. While we see many attempt to comply with the state and others that clearly do, we also see many shops and companies closing their doors that were once our favorites. We see our friends that were once growers of fine organic medicinal cannabis pushed out of the market by huge commercial growers who have the money to license up and grow in huge quantities. One of them near where I live kicks out over 100 pounds of Cannabis Buds monthly. Do we see this cannabis as consumers? I see quite a bit… and so far, I haven’t.

Mike Robinson, Medicinal Cannabis Patient

https://www.facebook.com/MikesEpilepsy

https://www.facebook.com/ThePlantMatters/

@NaturallyAwaken – Twitter

https://www.linkedin.com/in/mike-robinson-~-cannabis-heals-256b3192/

https://www.mikesmedicines.com/preferred-products/

Sign up to receive informative and exciting email updates from Mike's Medicines!

You can sign up for our mail list here:

Didn't find what you are looking for?

Find exactly what you want to when you want it.

Browse through our archives by date, category or by entering a topic in the provided search field.

Archives

Categories

More to come as we have time to add them – there’s 100’s of additional publications!